In a historic shift for cannabis policy, President Donald Trump has signed an executive order directing federal agencies to expedite the rescheduling of marijuana from a Schedule I to a Schedule III controlled substance under the federal Controlled Substances Act.

This development represents the most significant federal cannabis policy shift in decades and it has major implications for cannabis businesses, investors, patients, and the broader economy. The executive order signals a clear change in direction, it’s important to understand what rescheduling really means and what it doesn’t immediately do.

Let’s break it down.

What the Executive Order Actually Does

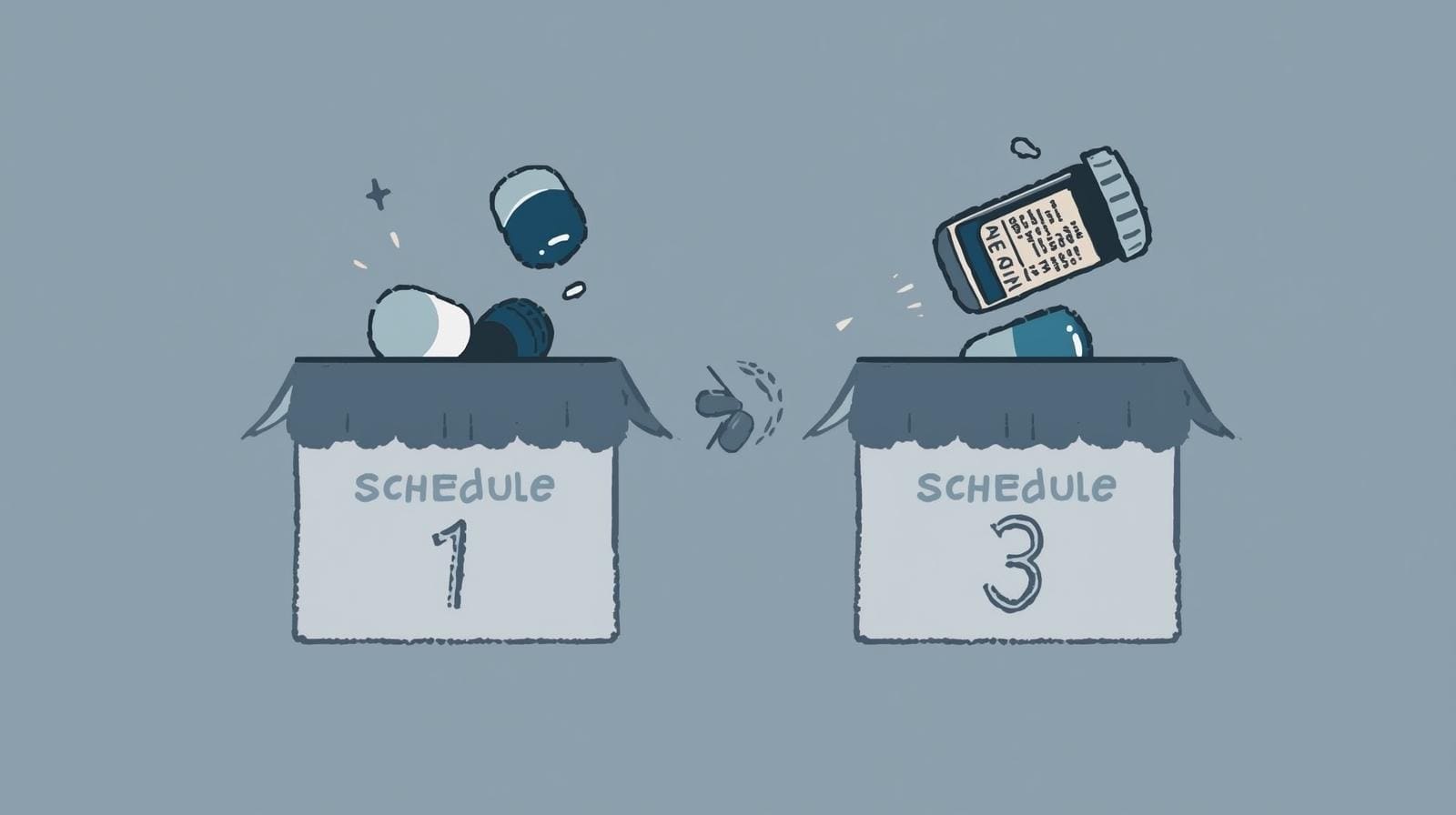

Setting the record straight off the bat, the executive order does not instantly legalize cannabis nationwide or change its legal status overnight. Instead, it directs the U.S. Attorney General to complete the formal rulemaking process to reclassify marijuana from Schedule I to Schedule III under the Controlled Substances Act.

Schedule I is the most restrictive category, reserved for substances that are deemed to have no accepted medical use and a high potential for abuse, a designation that has plagued cannabis for decades. By contrast, Schedule III drugs are recognized as having accepted medical use and a lower potential for abuse (examples include products like Tylenol with codeine).

While this executive order doesn’t finalize that change, it accelerates the timeline and signals clear federal intent to move rescheduling forward.

Why Rescheduling Matters for Cannabis Businesses

1. Tax Relief for State-Legal Cannabis Operators

One of the most consequential impacts for business owners would be the potential removal of Internal Revenue Code Section 280E as applied to cannabis operations. Currently, because marijuana is a Schedule I substance, cannabis businesses cannot deduct ordinary business expenses. This means higher tax burdens compared to other industries.

If rescheduling to Schedule III occurs, cannabis companies may become eligible to deduct normal business expenses (like rent, payroll, marketing, and utilities) on their federal tax returns just like other legal businesses. This could dramatically improve margins and cash flow.

2. Expanded Legal Recognition & Reduced Stigma

Though federal legalization would still require congressional action, rescheduling would be a massive symbolic victory. It formally acknowledges that cannabis has a legitimate medical use aligning federal policy with the reality of state programs that serve millions of patients.

This change also has the potential to reduce institutional risk for banks, investors, and insurers because the federal government is effectively saying cannabis is not the most dangerous drug on the books.

3. Easier Access to Research & Healthcare Integration

Rescheduling would also reduce barriers to clinical research. Cannabis has historically been difficult to study rigorously because of its Schedule I status. By empowering federal agencies to expand medical research into marijuana and CBD products, the executive order could catalyze new treatments, evidence-based standards, and insurance coverage pathways.

This could accelerate medical understanding of cannabis’s benefits, from chronic pain relief to opioid alternative therapies, an outcome many operators, patients, and healthcare advocates have long hoped for.

What Rescheduling Doesn’t Do (Yet)

It’s equally important to set realistic expectations:

- Rescheduling does not automatically legalize cannabis federally. Recreational and medical markets will still be governed by state laws until Congress acts.

- Federal banking reform is not automatic. While the executive order strengthens the case for banking reform, financial institutions and credit card networks will likely wait for explicit legislative change before opening full services to cannabis businesses.

- The rulemaking process takes time. The Attorney General and DEA must complete a formal process, which includes public notice, comment periods, and potential administrative reviews. That means rescheduling and its full effects could unfold over many months.

What This Means for Cannabis Accounting

For cannabis operators, this shift represents a once-in-a-generation potential tax transformation.

At Mindtrix Accounting, we’re already planning for scenarios like:

- New tax planning strategies post-280E elimination

- Optimized allocations of ordinary business expenses

- Revised accounting systems to support broader deductions

- Cash flow modeling under a new federal tax regime

Whether rescheduling ultimately happens or is delayed, preparation is the biggest advantage you can have.

Final Thoughts

This executive order marks a watershed moment for the cannabis industry but it is not the finish line. It’s a powerful signal that federal policy is shifting toward recognition of cannabis’s medical legitimacy and economic importance.

For cannabis CEOs, CFOs, and founders, this is the moment to educate your teams, refine your financial systems, and position your business for the opportunities ahead.

If you’re ready to navigate this transition with confidence, let’s talk.

Book a strategy call with Mindtrix Accounting, we’re here to help you make the most of what’s coming next.

Be The First To Comment